Contents

In 2025, over 76% of commercial real estate (CRE) firms are piloting or implementing AI tools to improve efficiency, reduce costs, and stay competitive. The shift isn’t driven by hype — it’s a response to rising operational costs, tenant expectations, and market pressures. For most CRE firms, AI isn’t about replacing people or overhauling entire systems overnight; it’s about solving specific problems faster and uncovering insights that drive strategic decisions.

CRE firms investing in AI aren’t just improving operations — they’re reducing costs, capturing market share, and future-proofing their portfolios. The question isn’t whether to adopt AI, but how quickly you can act before competitors pull ahead. From automating lease workflows to cutting energy costs, AI is helping CRE companies of all sizes achieve measurable wins. In this article, we’ll highlight the most impactful ways AI is transforming the CRE industry, address common concerns, and provide a practical roadmap with steps to help you get started.

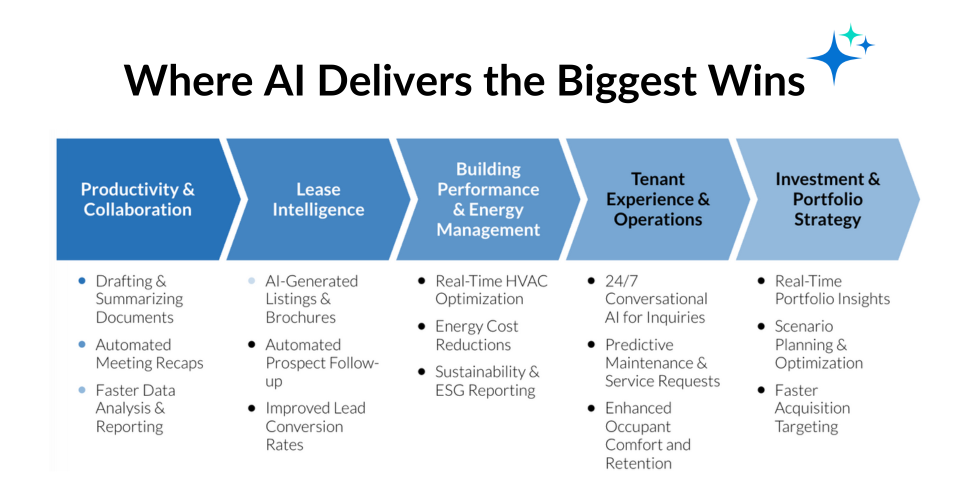

Where AI Delivers The Biggest CRE Wins

AI is quickly becoming one of the most valuable tools for commercial real estate firms. In a sector where even small operational gains can translate into huge savings or new revenue streams, AI is helping firms lease space faster, optimize building performance, and make sharper investment decisions. For CRE leaders willing to adopt early, the advantage is clear: stronger performance, faster growth, and a competitive edge in a rapidly evolving market.

Productivity and Collaboration

Administrative tasks and scattered communication drain time, delay deals, and frustrate teams. For CRE firms, AI-powered productivity tools like Microsoft 365 Copilot or Google Gemini are often the smartest first step — because they work inside the tools you already use.

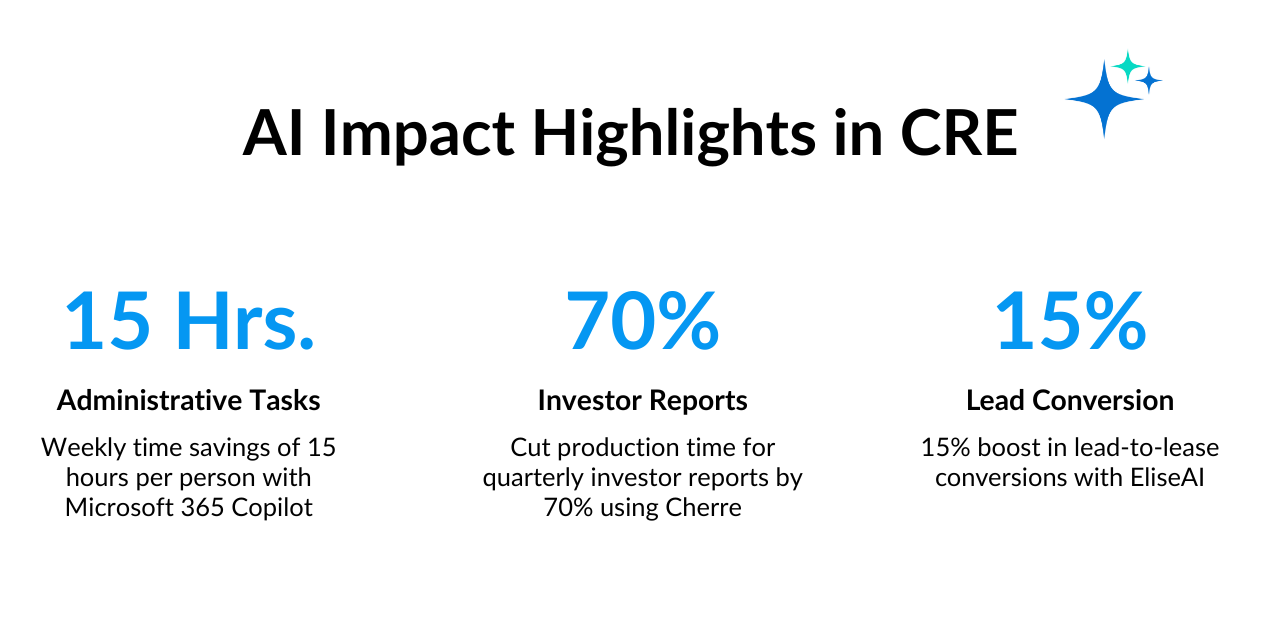

These AI assistants handle much of the tedious work — drafting and summarizing documents, creating meeting recaps, generating reports, analyzing occupancy data, and even building presentations — all without requiring highly specialized technical skills. The impact is nearly immediate: firms adopting AI productivity tools like Microsoft 365 Copilot report a weekly savings of 10-15 hours of time per on drafting, summarizing, and organizing tasks. That’s time directly reinvested into closing leases, managing assets, and growing revenue — instead of drowning in admin.

Lease Intelligence

Lease management has long been one of the most time-intensive and complex areas in commercial real estate, often requiring teams to navigate hundreds of pages per lease to extract critical information. For many landlords and investors, data is scattered across files and systems, creating inefficiencies, errors, and delayed decision-making. Prophia, an AI-powered lease intelligence platform, is changing that by using advanced models to extract, organize, and centralize lease data at scale. With Prophia, CRE teams can quickly query tenant data which allows you to verify, analyze, and manage your lease obligations with confidence.

Building Performance and Energy Management

Managing building performance and energy use is one of the clearest areas where AI delivers fast, measurable ROI. Commercial properties generate enormous data from sensors, HVAC systems, lighting, and occupancy monitors — far too much to manage manually. Hank, an AI-powered building optimization platform, solves this by analyzing HVAC performance, occupancy patterns, and weather in real time to fine-tune heating, cooling, and ventilation systems.

The platform integrates with most building management systems and often delivers major savings within months. Royal London Asset Management used Hank in a 125,000-square-foot office and saw a 21% total energy reduction, a 59% drop in HVAC energy use, and avoided 500 metric tons of CO₂ annually — a 708% return on investment for that single project. For CRE owners, AI-driven building optimization isn’t just about sustainability; it’s about converting complex data into immediate operational and financial gains.

Tenant Experience and Operations

In today’s market, tenants expect quick, personalized responses — whether they’re booking a tour, reporting a maintenance issue, or asking about amenities. For many property teams, meeting these expectations around the clock can overwhelm staff, slow response times, and lead to missed leasing opportunities.

AI-powered software like EliseAI solves this by offering 24/7 conversational AI agents that handle inquiries across email, text, and voice, while also managing tour scheduling, follow-ups, and predictive maintenance alerts. Operators like Landmark Properties, which manages over 100 apartment communities, saw a 15% boost in lead-to-lease conversions and saved over 85,000 staff hours annually after implementing EliseAI. By offloading routine interactions, teams can focus on building relationships, hosting community events, and improving retention — while AI ensures no lead or tenant request slips through the cracks.

Investment and Portfolio Strategy

Smaller and mid-sized investment firms often feel outmatched by large institutional players with deep pockets and dedicated data teams. This imbalance can slow deal sourcing, make reporting cumbersome, and limit access to insights that drive competitive decision-making. That’s where tools like Cherre, an AI-powered data integration and analytics platform, is helping level the playing field. By connecting hundreds of public and proprietary data sources — from tax assessments and mortgage records to market transactions and portfolio data — Cherre cleans, normalizes, and unifies everything into a single, reliable source of truth.

One investment firm managing only a few hundred million in assets, a fraction of its larger competitors, used Cherre to connect over 150 disparate data feeds. The result? They cut the time to produce quarterly investor reports by over 70% and uncovered acquisition opportunities by overlaying demographic trends with ownership and debt data — opportunities their competitors had overlooked. For firms seeking to compete more effectively, AI-driven platforms like Cherre are democratizing access to data, allowing leaner teams to make smarter, faster, and more confident investment decisions.

Addressing 3 Common Concerns

Despite the clear value, we often hear hesitation from CRE leaders considering AI. Most concerns boil down to three areas: cost, technical complexity, and fear of change. Here’s why these barriers aren’t as big as they seem.

- Cost: The AI investment is often the first barrier firms cite when considering AI, with many believing it’s prohibitively expensive and reserved for large corporations. That’s an outdated notion. Today’s AI tools are priced flexibly, with many designed specifically for small to mid-sized firms. Some solutions are simple add-ons to the software you already use — such as Microsoft 365’s Copilot — meaning adoption doesn’t always require a significant budget overhaul. Others operate on usage-based models, allowing firms to pay only for what they use, making it easier to control costs while still gaining the benefits of AI.

- Technical: Another frequent concern is the belief that a dedicated tech team is necessary to implement AI. In reality, most AI solutions for commercial real estate are built with intuitive, no-code interfaces designed for operational and management teams rather than IT departments. Onboarding can be straightforward, with vendor support and training available to ensure a smooth start.

- Change: Finally, fear of change remains a common hesitation. Change management can be challenging, but successful firms know it doesn’t have to be overwhelming. The key is to start small: pilot one AI tool in a single workflow, such as productivity, tenant relations, or equipment maintenance. As measurable results begin to appear, team confidence grows, adoption spreads naturally, and scaling becomes far less daunting. A clearly defined use case is critical — by targeting the area where your team needs the most relief or the highest potential ROI, you can build momentum and reduce resistance.

Getting Started With AI

Achieving meaningful results with AI requires more than simply introducing a new tool and hoping it gains traction. Organizations that generate real value from AI do so through a thoughtful combination of strategy, intentional execution, and committed leadership. In our experience, successful AI implementation consistently hinges on three key elements: a well-defined strategy, use case–driven training, and clear leadership accountability.

Importantly, if your internal team is not yet equipped to lead the organization through AI-related strategy, training, and transformation, partnering with a specialized AI consultancy is more effective than a do-it-yourself approach. The right AI partner can accelerate progress, avoid costly missteps, and ensure that AI efforts align with broader business objectives from the outset.

- Identify Pain Points: Begin by analyzing where your processes face the most friction—this could be delays, rework, cost overruns, or inefficiencies. A clear understanding of these challenges sets the foundation for targeted, high-impact AI applications.

- Assess Impact vs. Effort: Not all AI initiatives are created equal. Start with low-effort, high-impact opportunities—what we call "quick wins"—to demonstrate early value and gain internal momentum.

- Build a Roadmap: Develop a phased implementation plan that aligns with your business goals. Assign clear ownership, establish KPIs, and allocate time for team training and change management.

- Select & Execute: With a roadmap in place, move forward with disciplined execution. Monitor progress, capture learnings, and iterate as needed to ensure long-term success and scalability.

CRE leaders are already seeing 700%+ ROI on targeted AI initiatives. Ready to find your biggest wins? Take our AI Readiness Assessment or schedule a no-pressure strategy call to get started. Together, we can transform the complexities of operational success into opportunities for growth and prosperity.